Roots Analysis has announced the addition of “Digital Twins Market, 2022-2035” report to its list of offerings.

Since the first application of the digital twin concept for manufacturing in 2002, it has emerged as a crucial component for companies to achieve higher efficiency in their production processes. According to the US-based Digital Twin Consortium, digital twins hold the potential to reduce clinical trial expenditure, turnaround times, staffing expenses and plan medical intervention. Digital twin technology companies are currently engaged in the development of products which are intended for numerous applications, such as asset / process management, personalized treatment and surgical planning.

Key Market Insights

Over 35 digital twins are presently available in this market space

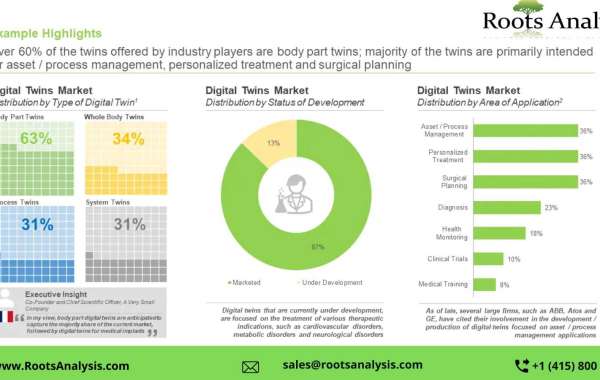

More than 60% of the digital twins offered by industry players are body part twins; these products are primarily intended for asset / process management, personalized treatment and surgical planning. Further, majority of the products that are currently under development are focused on the treatment of indications, such as cardiovascular disorders, metabolic disorders, and neurological disorders.

More than 30 players currently claim to be engaged in the digital twin domain

Majority of the players engaged in this industry are small firms (11-50 employees, 37%), followed by very large players (10,000+ employees, 22%), large players (501-10,000 employees, 19%), mid-sized players (51-500 employees, 13%) and very small companies (2-10 employees, 9%). Additionally, nearly 70% of the developers are based in Europe, followed by those based in North America (28%).

Partnership activity for digital twins witnessed a CAGR of over 15%, in the past three years

More than 50% of the partnerships have been signed since January 2020; of these, four partnerships were inked in the year 2022. Technology integration agreements have emerged as the most popular (30%) type of partnership model in the market, followed by technology utilization agreements (23%).

Nearly USD 6 billion invested across the globe to advance digital twins focused initiatives

A steady increase has been observed in funding activity since 2020, with the maximum number of instances (10) being reported in the year 2021. In fact, more than 90% of the total investment (in terms of the amount invested) was made in the last two years alone (2021- 2022). Of the amount raised in 2022, about USD 4.2 billion was contributed by the IPO of Babylon.

Berkus start-up valuation analysis has been performed to evaluate start-ups in this domain

The framework enables valuation of start-ups, based on several key success / risk factors . The key factors are assigned monetary values based on the qualities / risks possessed by a particular player. At the end, all valuations were added to calculate the final valuation of the company.

Players based in North America are anticipated to capture nearly 30% of the market share by 2035

The overall digital twin market is expected to be primarily driven by the growing interest towards automation and prognostic systems. The estimates in our report suggest that digital twins intended to treat cardiovascular disorders are expected to hold 32% share of the market in 2035. It is interesting to mention that market for digital twins intended to serve pharmaceutical companies and medical device manufacturers, collectively, hold over 60% of the market share in 2035.

To request a sample copy / brochure of this report, please visit this https://www.rootsanalysis.com/reports/digital-twins-market/request-sample.html

Key Questions Answered

- Who are the leading players engaged in the development of digital twins for the healthcare domain?

- Which type of digital twin is most commonly offered by developers engaged in this market space?

- What is the relative competitiveness of different players engaged in the digital twins domain?

- What is the likely valuation of start-ups involved in the development of digital twins for the healthcare sector?

- What is the present and likely future demand for digital twins in the overall healthcare sector?

- What are the anticipated future trends related to digital twins in the healthcare domain?

- How is the current and future opportunity likely to be distributed across key market segments?

The financial opportunity within the digital twins market in the healthcare domain has been analyzed across the following segments:

- Therapeutic Area

- Cardiovascular Disorders

- Metabolic Disorders

- Orthopedic Disorders

- Other Disorders

- Type of Digital Twin

- Process Twins

- System Twins

- Whole Body Twins

- Body Part Twins

- Area of Application

- Asset / Process Management

- Personalized Treatment

- Surgical Planning

- Diagnosis

- Other Applications

- End Users

- Pharmaceutical Companies

- Medical Device Manufacturers

- Healthcare Providers

- Patients

- Other End Users

- Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

The research includes profiles of key players (listed below); each profile features a brief overview of the company, details related to its recent developments (including funding and collaborations) and an informed future outlook.

- Babylon

- ExactCure

- ImmersiveTouch

- Navv Systems

- ThoughtWire

- AI

For additional details, please visit https://www.rootsanalysis.com/reports/digital-twins-market.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Flow Cytometry Service Market, 2022-2035

- Gene Editing beyond CRISPR Market, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact Information

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091