As blockchain technology continues to grow and decentralization becomes a cornerstone of modern finance, one key factor has emerged to define user experience: transaction costs. In many ways, the cost of using a network—often measured in “gas fees” or transaction fees—can be the make–or–break factor for both users and developers. This blog post delves into the gas fee structures of Ethereum and Solana, examines the benefits of low fees for microtransactions, and explains how these differences impact decentralized finance (DeFi), non–fungible tokens (NFTs), and everyday transactions.

1. Introduction

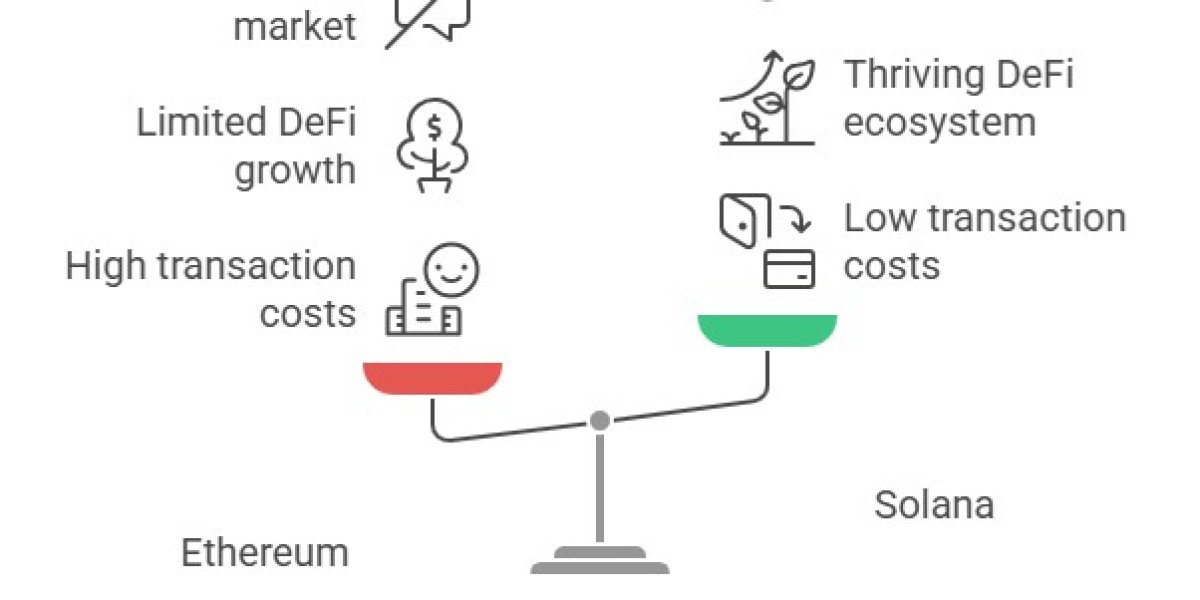

In the evolving world of decentralized applications, blockchain networks are more than just platforms for transferring digital assets. They are ecosystems where every transaction incurs a cost, and these costs have significant implications for adoption, usability, and innovation. Ethereum, the pioneer behind smart contracts, has long been central to this conversation. However, its robust and versatile platform comes with high gas fees—especially during network congestion—which can inhibit small–value transactions and limit accessibility for everyday users and developers alike.

In contrast, Solana has positioned itself as a high–performance alternative with extremely low transaction fees. Its design philosophy centers on delivering speed and efficiency without sacrificing security, making it particularly appealing for applications that require microtransactions and high–frequency interactions. In the following sections, we explore why these fee differences matter and how they will shape the future of blockchain applications.

2. Ethereum’s Gas Fee Structure: A Double-Edged Sword

How Gas Fees Work on Ethereum

Ethereum’s transaction fee mechanism is built around the concept of “gas.” Every operation executed on the Ethereum Virtual Machine (EVM)—from transferring tokens to running a complex smart contract—requires a certain amount of gas. Users pay these fees in Ether (ETH), and two factors determine the cost of a transaction:

- Base Fee: This fee adjusts automatically based on network demand. Introduced in a significant upgrade, it is burned rather than given to miners, reducing the total supply of Ether over time.

- Tip (Priority Fee): To incentivize faster processing, users can add a tip to prioritize their transactions.

While these mechanisms ensure that the network operates securely and efficiently, they also lead to variable transaction costs. During periods of high demand, such as when a popular decentralized finance protocol experiences a surge in trading volume or a highly anticipated NFT drop occurs, gas fees can skyrocket. This variability can be a significant obstacle for smaller transactions or projects with tight budgets.

The Impact on Users and Developers

High gas fees on Ethereum have far-reaching consequences:

- For Developers: Building decentralized applications (dApps) on Ethereum becomes more challenging when every user interaction can incur a significant cost. Developers must factor these fees into their business models, sometimes leading to more complex fee–sharing mechanisms or the need for layer–2 solutions to reduce costs.

- For Users: Individuals wishing to make everyday transactions, such as transferring tokens or minting an NFT, may find the fees prohibitively expensive. This barrier discourages participation and limits the network’s use cases, especially for microtransactions, which are the backbone of many DeFi protocols.

Despite ongoing efforts to implement layer-2 solutions (which move transactions off the main Ethereum chain), the base layer’s limitations persist. Users can still experience frustration during high–traffic periods and developers continue to explore ways to mitigate these costs through scaling technologies and optimization strategies.

Economic Implications of High Fees

Ethereum’s fee structure has broader implications for the blockchain’s overall ecosystem. High transaction costs can lead to a concentration of economic activity among high–value users and institutional players, leaving retail investors and smaller projects on the sidelines. In this environment, innovation can be stifled because experimentation becomes expensive, raising the barrier to entry for new developers.

3. Solana’s Minimal Fees: Designed for Efficiency

The Architecture Behind Low Fees

Solana was engineered with a different philosophy from the ground up. Its hybrid consensus mechanism—combining Proof-of-History (PoH) with Proof-of-Stake (PoS)—allows the network to efficiently process thousands of transactions per second. This high throughput is achieved by creating a verifiable record of events (PoH), which minimizes the amount of communication needed between nodes. As a result, the network experiences significantly lower latency and can maintain minimal transaction fees.

Benefits for Microtransactions

Low fees are particularly beneficial for microtransactions—small–value transfers that would be impractical on networks with high fees. Here are several ways in which Solana’s cost–efficiency drives innovation:

- Enabling High–Frequency Trading: Decentralized exchanges (DEXs) and DeFi platforms must execute trades cheaply. Solana’s minimal fees allow for rapid, high–volume transactions without the overhead of expensive gas costs.

- Facilitating NFT Minting and Trading: In the NFT space, creators and collectors benefit from low transaction fees, which reduce the cost of minting, buying, and selling digital art. This affordability can foster greater experimentation and more frequent trading, driving overall market activity.

- Supporting Everyday Use Cases: Low fees lower the barrier to entry for everyday transactions, such as paying for services, transferring tokens, or engaging in social applications on decentralized networks. Solana is an ideal platform for these transactions requiring speed and cost efficiency.

Economic Advantages and User Adoption

Solana’s economic model is designed to encourage widespread participation. With fees typically measured in fractions of a cent, users are likelier to engage in smaller, everyday transactions. For developers, this means a lower risk when building applications that require frequent interactions or micropayments. As a result, Solana’s ecosystem is beautiful for projects that aim to tap into new use cases, such as gaming dApps and social networks, where cost-effectiveness is paramount.

4. Impact on DeFi, NFTs, and Everyday Transactions

Decentralized Finance (DeFi)

DeFi platforms rely heavily on the ability to execute rapid, low–cost transactions. High fees can erode the profitability of lending, borrowing, and trading protocols, making them less appealing to users and liquidity providers. With Ethereum, the higher gas fees have sometimes forced projects to explore alternative networks or layer-2 solutions to reduce costs.

Solana’s low transaction costs create an environment where DeFi protocols can thrive even under heavy load. For instance, decentralized exchanges operating on Solana can process thousands of trades per second without imposing significant user fees. This advantage improves the overall user experience and attracts more liquidity into the network, strengthening its DeFi ecosystem.

Non–Fungible Tokens (NFTs)

The NFT market is another area where transaction costs are crucial. Minting an NFT on Ethereum can be expensive, particularly during periods of high network demand. High gas fees have been a frequent criticism for NFT creators, who must balance the cost of creation with potential returns. As a result, some artists and developers have begun exploring alternative blockchains to mint and trade their NFTs.

With its minimal fees, Solana offers a compelling alternative for NFT projects. Low costs allow creators to experiment more freely and offer NFTs at lower prices, potentially opening up the market to a broader audience. Additionally, collectors benefit from lower transaction fees when buying, selling, or transferring NFTs. This creates a more vibrant marketplace with increased trading volumes and greater accessibility for all participants.

Everyday Transactions

Beyond specialized applications like DeFi and NFTs, everyday transactions on blockchain networks are also affected by fee structures. For many users, blockchain technology promises to enable fast and secure financial transactions without intermediaries. However, when the cost to execute these transactions is high, everyday usage becomes impractical.

Ethereum’s fluctuating and often high fees have made it challenging for users to adopt the network for routine transactions. Whether paying for goods or transferring funds, the high cost can be a deterrent, especially for small–value operations. In contrast, Solana’s minimal fees make it an ideal platform for everyday use cases. With transaction costs remaining consistently low, users can enjoy the benefits of decentralized finance without worrying about prohibitive fees, encouraging broader adoption and more frequent transactions.