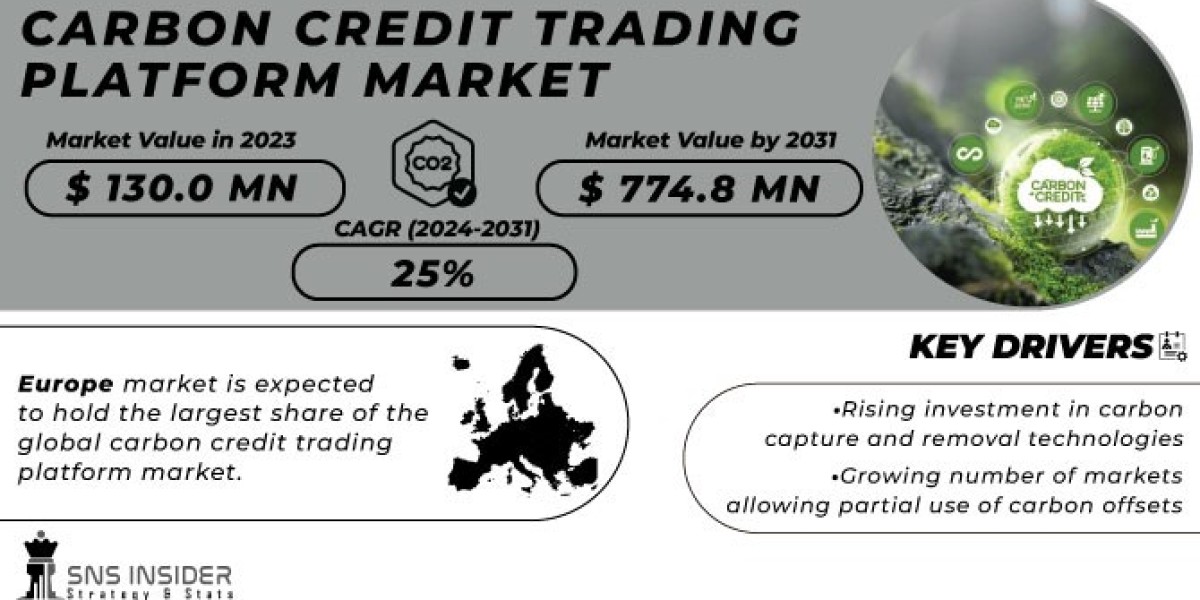

The Carbon Credit Trading Platform Market size was valued at USD 130.0 million in 2022 and is expected to reach USD 774.8 million by 2031 with a growing CAGR of 25% over the forecast period of 2024–2031

Carbon credit trading allows companies to offset their carbon emissions by purchasing carbon credits, representing one ton of CO₂ or equivalent emissions removed or prevented from entering the atmosphere. These platforms provide a marketplace where companies and organizations can trade credits to meet environmental commitments, helping to finance clean energy projects, reforestation, and sustainable technologies. As more businesses strive to meet net-zero targets, the demand for carbon credits is increasing, particularly in sectors like manufacturing, energy, and transportation.

The global focus on decarbonization and compliance with regulatory frameworks is encouraging the adoption of digital carbon credit trading platforms. These platforms are increasingly incorporating blockchain technology, artificial intelligence (AI), and advanced analytics to enhance transparency, ensure the authenticity of credits, and facilitate seamless trading experiences.

Key Market Drivers

- Growing Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, encouraging companies to reduce emissions or offset them through carbon credits.

- Corporate Sustainability Goals: With a strong shift towards sustainability, corporations are setting ambitious carbon neutrality targets, spurring demand for carbon credits as a means to bridge the gap in their emission reductions.

- Increased Demand for Transparent Trading: Concerns over carbon credit authenticity and traceability are driving the adoption of platforms that offer real-time tracking, secure transactions, and transparency, often using blockchain technology.

- Advancements in Blockchain Technology: Blockchain is increasingly being integrated into carbon credit trading platforms to enhance security, traceability, and trustworthiness, fostering confidence in the carbon credit market.

- Expansion of Voluntary Carbon Markets: As awareness of climate issues grows, voluntary carbon markets are expanding, offering companies a way to demonstrate their commitment to sustainability independently of regulatory requirements.

Market Segmentation

The Carbon Credit Trading Platform Market can be segmented by platform type, technology, end-user industry, and region.

By Platform Type

- Compliance Platforms: Designed for companies operating in regulated markets, compliance platforms allow industries to meet mandated emissions reduction goals by trading credits to offset excess emissions.

- Voluntary Platforms: Voluntary platforms serve organizations seeking to offset emissions as part of their corporate social responsibility initiatives, catering to non-regulated sectors.

By Technology

- Blockchain-Based Platforms: Blockchain technology offers secure and transparent tracking of carbon credits, ensuring the credibility of traded credits. These platforms are gaining popularity for their ability to reduce fraud and double-counting in credit transactions.

- AI-Enhanced Platforms: AI technologies are being leveraged to analyze carbon credit demand, optimize pricing strategies, and forecast credit availability, enhancing platform efficiency.

- Standard Platforms: These traditional platforms provide carbon trading without advanced technological integration, often catering to regions with limited digital infrastructure.

By End-User Industry

- Energy and Utilities: Energy companies, particularly in oil, gas, and utilities, are increasingly utilizing carbon credits to offset their emissions and meet regulatory requirements.

- Manufacturing: Heavy industries, including steel and cement manufacturing, are adopting carbon credit trading as a means to mitigate their high emission levels.

- Transportation: Airlines, shipping companies, and logistics providers are incorporating carbon credits to offset emissions from fuel consumption and meet sustainability goals.

- IT and Technology: Technology companies are increasingly using carbon credits to offset the emissions associated with data centers and global operations, often aiming for carbon-neutral commitments.

Regional Analysis

- North America: North America is a major player in the carbon credit trading market, driven by environmental regulations and corporate commitments to sustainability. The U.S. and Canada are investing in blockchain and AI technologies to enhance transparency and compliance in carbon trading.

- Europe: Europe is at the forefront of carbon credit trading, with a mature regulatory market under the EU Emissions Trading System (EU ETS). Countries like Germany, France, and the U.K. are leading in both compliance and voluntary carbon markets, supported by progressive climate policies and corporate sustainability goals.

- Asia-Pacific: Asia-Pacific is an emerging market for carbon credit trading platforms, with countries such as China, Japan, and South Korea implementing national carbon trading schemes to achieve carbon neutrality. The region is experiencing rapid industrialization and high emissions, driving the need for effective carbon offset mechanisms.

- Latin America: In Latin America, countries like Brazil are increasingly adopting carbon credit trading to protect rainforests and promote biodiversity. Carbon credits are becoming an essential part of sustainable forestry and reforestation projects, contributing to the region’s environmental preservation.

- Middle East & Africa: The Middle East and Africa are adopting carbon credit trading to diversify energy portfolios and reduce emissions in the oil and gas sectors. Countries like the UAE are investing in carbon offset solutions as part of their broader sustainability goals.

Read Complete Report Details of Carbon Credit Trading Platform Market: https://www.snsinsider.com/reports/carbon-credit-trading-platform-market-2794

Current Market Trends

- Blockchain Integration for Transparency: Blockchain technology is being widely adopted to ensure transparency in carbon credit transactions, making it easier to track and verify credits, thus improving market credibility.

- Rise of Voluntary Carbon Markets: With heightened corporate and consumer awareness, voluntary carbon markets are expanding rapidly, offering companies a way to demonstrate environmental commitment beyond regulatory requirements.

- AI and Machine Learning Applications: AI and machine learning are being used to optimize credit pricing, forecast demand, and improve trading efficiency, enhancing user experience on carbon trading platforms.

- Digital Platforms for Small Businesses: Carbon credit platforms are increasingly catering to small and medium-sized enterprises (SMEs), enabling smaller players to participate in the carbon market and enhance their sustainability credentials.

- Expansion of Carbon Offset Projects: More companies are investing in carbon offset projects, including reforestation and renewable energy initiatives, to create credits that support long-term sustainability.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand — Head of Business Development & Strategy

info@snsinsider.com

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)