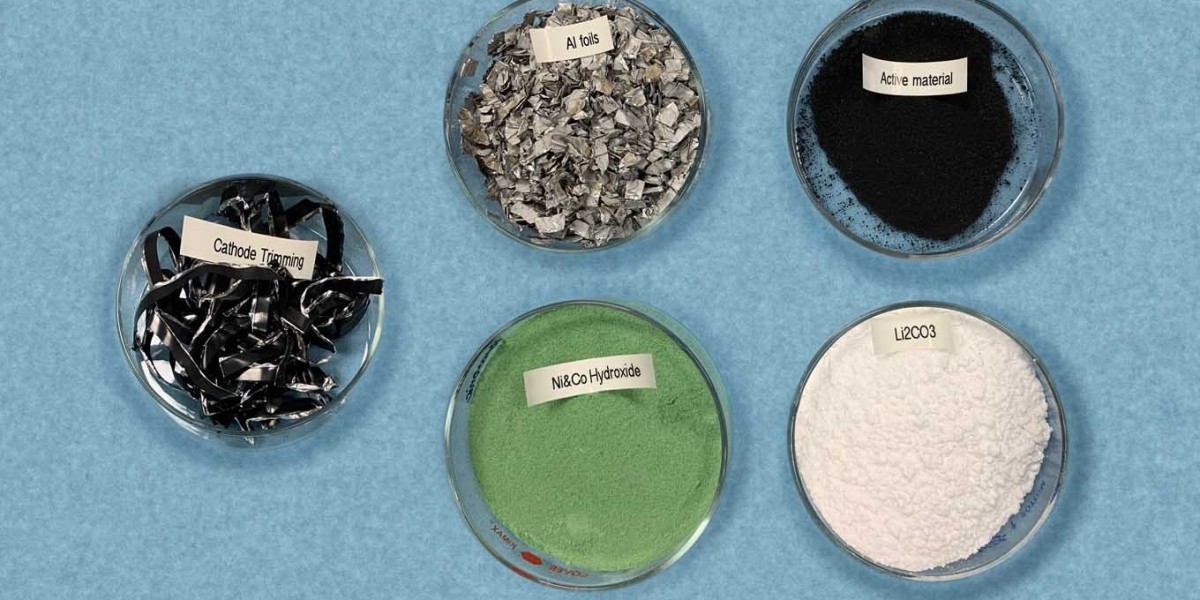

The battery materials market comprises materials like cathode materials, anode materials, electrolyte materials, separators, and other battery materials used in manufacturing batteries that power various devices including consumer electronics, electric vehicles (EVs), grid storage, and other industrial applications. Cathode materials used in lithium-ion batteries include lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium nickel cobalt aluminum oxide, and lithium iron phosphate. Anode materials prominently include graphite and lithium titanite. Battery materials provide energy storage to batteries while enabling long cycle life, high energy density, and safety.

The global battery materials market is estimated to be valued at US$ 50.6 billion in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period between 2023 to 2030.

Key Takeaways

Key players operating in the battery materials market are Albemarle, China Molybdenum Co. Ltd., Gan feng Lithium Co., Ltd., Glencore PLC, Livent Corporation, Norlisk Nickel, Sheritt International Corporation, SQM S.A., Targray Technology International Inc., Teck Resources, Tianqi Lithium, and Vale S.A. These players are focusing on expanding production capacities and developing advanced and sustainable battery materials to gain a competitive edge in the market.

The demand for battery materials is expected to grow significantly driven by the growing sales of electric vehicles worldwide on account of stringent emission norms and policies supporting clean mobility. Also, increasing adoption of consumer electronics and demand for grid energy storage solutions are fueling the consumption of battery materials.

Major battery materials companies are investing heavily in developing native mining operations and refining facilities across key markets to establish a global supply network and production footprint. They are focusing on regions with rich mineral reserves like Australia, Chile, Argentina, and China to secure the supply of critical and scarce battery raw materials.

Market Key Trends

The demand for high-nickel cathode materials is gaining traction in the battery materials market. Automakers are favoring lithium-ion batteries powered by high-nickel cathodes as they provide higher energy density and allow EVs to go longer distances on a single charge. While high-nickel cathodes are more expensive than other chemistries currently, battery pack costs are expected to reduce with rising production volumes. Top players are aggressively expanding nickel matte and sulfate production capacities to capitalize on the growing preference for high-energy lithium-ion batteries.

Porter's Analysis

The threat of new entrants in the battery materials market is moderate. Although capital requirements for setting up mining and processing facilities is high, newer materials like silicon and lithium iron phosphate have low barriers to entry.

The bargaining power of buyers like battery and automotive manufacturers is moderate to high given the commoditized nature of raw materials and bulk purchases made.

Global suppliers have significant bargaining power given the oligopolistic supply landscape and investments required in large-scale mining projects.

The threat of substitute materials is high with continuous R&D in areas like sodium-ion and solid-state batteries.

Industry players compete intensely in scaling up production and lowering costs to win large supply contracts.

China dominates the battery materials market accounting for over 50% of the global value, being the world's largest consumer and producer of lithium-ion batteries which find use in electric vehicles, consumer electronics and energy storage. Australia is another major region concentrated with large mines of graphite, lithium and nickel compounds. South America, mainly Chile and Argentina also have large lithium reserves catering to the growing global demand.

Europe is witnessing the fastest growth in the battery materials space driven by investments in battery gigafactories and electric vehicle manufacturing facilities. Countries like Germany, Sweden and Finland are emerging as hotspots with innovative battery chemistries and production technologies. Demand is also picking up rapidly across developing Asian economies like India, Indonesia and Vietnam as electric mobility gains traction.

Geographical Regions

China accounts for over 50% of the global market value for battery materials concentrated with large producers of lithium, graphite, cobalt and nickel compounds. Australia is another major region concentrated with large mines of graphite, lithium, nickel and cobalt compounds catering to the growing global demand.

Europe is witnessing the fastest growth in the battery materials space driven by investments in battery gigafactories and electric vehicle manufacturing facilities. Countries like Germany, Sweden and Finland are emerging as hotspots with innovative battery chemistries and production technologies. Demand is also picking up rapidly across developing Asian economies like India, Indonesia and Vietnam as electric mobility gains traction in these markets.