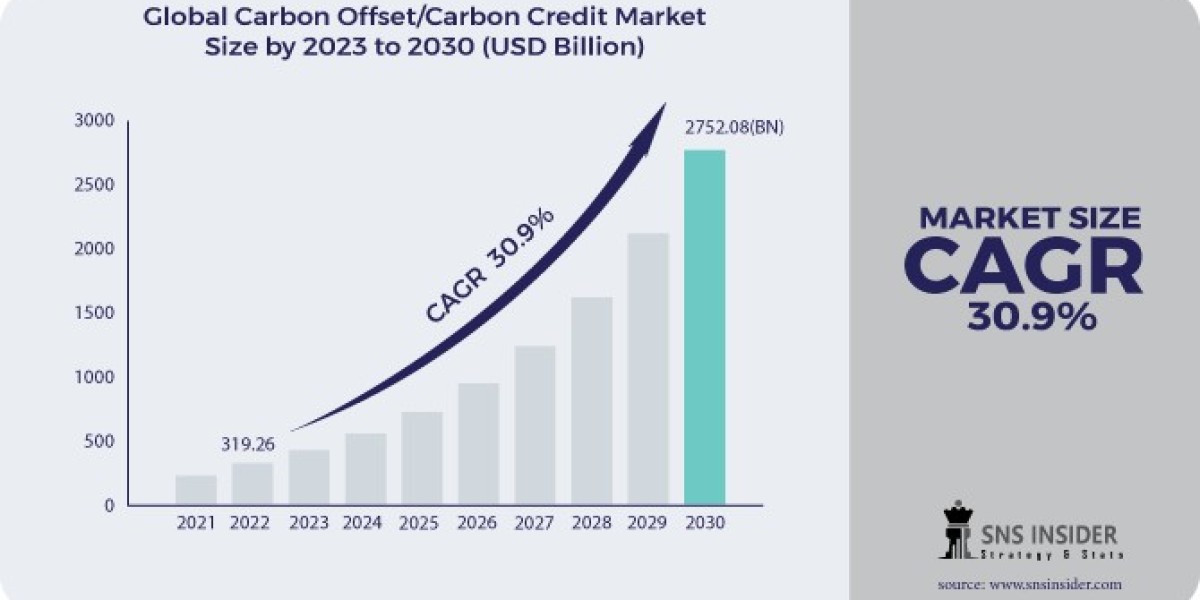

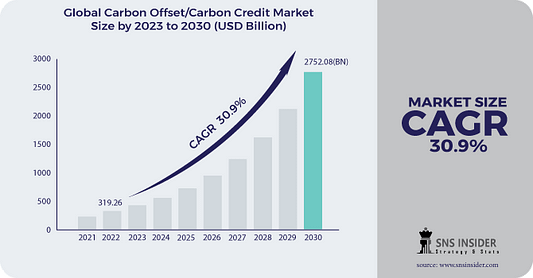

The Carbon Offset/Carbon Credit Market size was valued at USD 428.80 billion in 2023 and is expected to grow to USD 3541.13 billion by 2031 and grow at a CAGR of 30.2% over the forecast period of 2024–2031.

Carbon credits serve as tradable certificates that companies or individuals can purchase to offset their emissions by supporting carbon reduction projects such as reforestation, renewable energy projects, or carbon capture and storage (CCS). They allow organizations to balance their carbon output while investing in environmental initiatives. The market includes compliance-based carbon credits, used to meet regulatory obligations, and voluntary credits, purchased by companies aiming to offset emissions beyond regulatory requirements.

The growing demand for carbon offsets stems from global efforts to address the impacts of climate change. With more countries joining the Paris Agreement’s goals to limit global temperature rise, carbon credits offer a viable pathway to support emission reduction commitments. For businesses, participation in the carbon market also enhances brand image, meets investor demands, and aligns with corporate social responsibility (CSR) objectives.

Request Sample Report@ https://www.snsinsider.com/sample-request/2839

Key Market Drivers

- Regulatory Compliance: Governments worldwide are mandating stricter emissions reduction targets, driving demand for compliance-based carbon credits. These regulations are particularly impactful in sectors with high emissions, such as manufacturing, energy, and transportation.

- Corporate Net-Zero Commitments: As businesses increasingly set ambitious climate goals, carbon credits provide a way to achieve emissions reductions that are challenging to address through internal changes alone.

- Rising Demand in Voluntary Markets: Voluntary carbon offsets are growing as companies aim to exceed compliance requirements and demonstrate proactive environmental stewardship. The demand is particularly high in sectors with ambitious sustainability commitments, like tech, finance, and retail.

- Growing Awareness and Public Pressure: Consumers and stakeholders are holding companies accountable for their environmental impact. Participation in carbon offset programs enables organizations to reduce their carbon footprint and respond to consumer demand for sustainable practices.

- Innovation in Carbon Sequestration and Offset Verification: Technological advancements, including remote sensing and blockchain, are making carbon credits more traceable and reliable, increasing confidence in their effectiveness.

Market Segmentation

The Carbon Offset/Carbon Credit Market is segmented by project type, end-use industry, market type, and region.

By Project Type

- Forestry and Land Use: This category includes reforestation, afforestation, and forest conservation projects that absorb carbon through natural processes.

- Renewable Energy: Renewable energy projects, such as solar and wind power, prevent emissions by replacing fossil-fuel-generated power with cleaner sources.

- Carbon Capture and Storage (CCS): CCS projects involve capturing emissions at their source and storing them underground or using them in products to prevent them from entering the atmosphere.

- Agricultural Projects: Initiatives like methane reduction in livestock and sustainable farming practices that improve soil carbon sequestration contribute to this category.

- Waste Management: Projects aimed at methane capture from landfills and wastewater treatment plants prevent greenhouse gas emissions by managing waste more sustainably.

By End-Use Industry

- Energy and Utilities: Energy companies, particularly those reliant on fossil fuels, use carbon offsets to meet compliance standards and work towards net-zero goals.

- Manufacturing: As a high-emission sector, manufacturing relies on carbon credits to offset the emissions generated in production processes.

- Transportation: Airlines and automotive companies invest in carbon credits to mitigate the impact of emissions from fuel usage.

- Commercial and Retail: Retail and commercial businesses purchase carbon offsets to meet sustainability goals and appeal to eco-conscious consumers.

- Others: Includes industries like agriculture, real estate, and hospitality, which are increasingly investing in offsets as part of broader sustainability initiatives.

Buy a Complete Report of Carbon Offset/Carbon Credit Market 2023–2030@ https://www.snsinsider.com/checkout/2839

By Market Type

- Compliance Market: Also known as the regulated market, the compliance segment includes companies mandated by government regulations to purchase carbon credits.

- Voluntary Market: Companies and individuals voluntarily purchase carbon offsets to fulfill CSR and net-zero goals. The voluntary market is growing as awareness of climate change increases.

Regional Analysis

- North America: The United States and Canada are leading markets due to supportive government policies, corporate sustainability commitments, and consumer-driven demand for environmental responsibility.

- Europe: Europe is at the forefront of carbon market development, particularly through the European Union Emissions Trading System (EU ETS), which has set strict emissions targets across industries.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is experiencing rapid market growth due to government-backed carbon reduction policies and the expansion of renewable energy projects.

- Middle East & Africa: The market is gradually expanding as oil-producing countries invest in carbon capture and renewable energy to diversify their economies.

- Latin America: Latin America is increasingly involved in the carbon offset market, with Brazil leading reforestation and forest conservation projects.

Current Market Trends

- Blockchain for Carbon Credit Tracking: Blockchain technology is enhancing transparency and traceability in the carbon credit market, ensuring credits are genuine and verifiable, which builds buyer confidence.

- Corporate Sustainability Integration: Large corporations are integrating carbon credits as part of their overall sustainability strategies, including incorporating them in employee incentives and corporate initiatives.

- Investment in Nature-Based Solutions: Nature-based carbon sequestration projects, like forest conservation and wetland restoration, are increasingly preferred by companies looking for effective, long-term offset solutions.

- Carbon Capture Innovations: Technological advancements in CCS and Direct Air Capture (DAC) are paving the way for high-quality carbon offset projects that provide long-term emissions reductions.

- Government Partnerships: Governments are collaborating with private entities to scale offset programs, supporting national emissions targets while providing additional resources to private sectors for compliance.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand — Head of Business Development & Strategy

info@snsinsider.com

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)