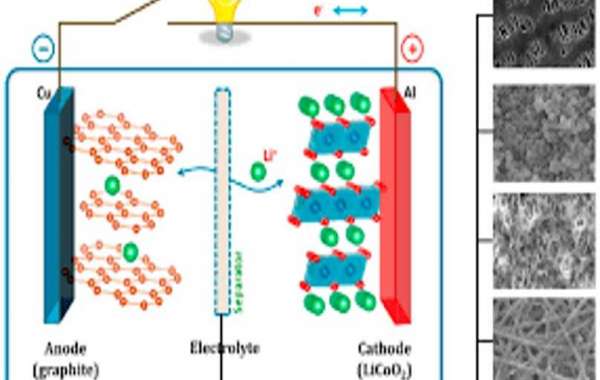

Battery materials are primarily used in various rechargeable battery applications including consumer electronics, electric vehicles, and energy storage systems. Key battery materials include cathode materials such as lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium iron phosphate; and anode materials such as natural and synthetic graphite, silicon, lithium titanate.

The battery materials market is estimated to be valued at US$ 50.6 Bn in 2023 and is expected to exhibit a CAGR of 6.0% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The battery materials market is witnessing high growth owing to increasing demand for rechargeable batteries from various end-use industries such as consumer electronics and electric vehicles. For instance, growing sales of electric vehicles around the world is increasing the use of lithium-ion batteries in automotive applications which in turn is driving the demand for battery materials such as cathode and anode materials. Additionally, rising adoption of consumer electronics devices such as smartphones, laptops, power banks is fueling the incorporation of lithium-ion batteries in these devices thereby augmenting the market growth. Furthermore, increasing deployment of grid-scale energy storage systems for renewable energy integration and energy management is also contributing to the battery materials demand.

SWOT Analysis

Strength: The battery materials market has seen huge investments in recent years to increase production capacity. Increase in demand for lithium-ion batteries from consumer electronics and electric vehicles is driving the market. Continuous research and development is leading to discovery of new battery materials with improved efficiency and lifespan.

Weakness: Volatility in raw material prices can impact the margins and profits of battery materials companies. Dependence on few countries for supply of critical raw materials like lithium, cobalt, nickel increases geopolitical risk. High capital expenditure is required to set up large scale production facilities.

Opportunity: Growing demand for energy storage solutions from increase in renewable power generation provides growth opportunities. Rapid adoption of electric vehicles worldwide will boost the consumption of battery materials over the coming years. Development of solid-state batteries using newer materials will open new avenues.

Threats: Trade disputes and tariffs can disrupt supply chains. Stringent environmental regulations around mining and processing of raw materials increase compliance costs. Slowdown in automobile or electronics sector will dent the demand.

Key Takeaways

The global battery materials market is expected to witness high growth, exhibiting CAGR of 6.0% over the forecast period, due to increasing demand for lithium-ion batteries from growing electric vehicle sales and deployments of renewable energy. The market size for 2023 is US$ 50.6 Bn.

Regional analysis: Asia Pacific region currently dominates the global battery materials market due to presence of major battery and electric vehicle producers in China, South Korea and Japan. The region is estimated to account for more than 50% market share in 2030 driven by government promotion of green mobility in major economies. North America and Europe are other major battery materials markets fueled by expanding electric vehicle fleet and energy storage projects.

Search

- Friendly Websites www.wsisw.com www.bybit.com www.temu.com www.ebay.com www.adsy.com www.iherb.com www.whmcs.com www.secsers.com www.cambly.com www.binance.com www.displate.com www.magenet.com www.gainrock.com www.seoclerks.com www.aliexpress.com www.freelancer.com www.rankranger.com www.wehaveoffer.com www.qrmenutable.com www.coinpayments.net www.linksmanagement.com

Popular Posts