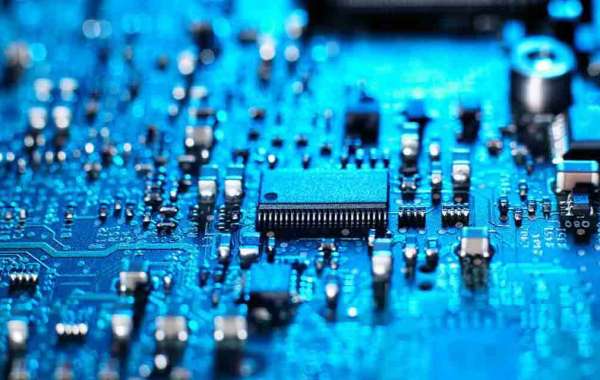

The next generation memory technologies market comprises of emerging memory technologies such as MRAM (Magnetoresistive random-access memory), FRAM (Ferroelectric random-access memory), ReRAM (Resistive random-access memory), and 3D XPoint. These technologies are designed to overcome limitations of existing memory technologies such as Flash, DRAM, and SRAM in terms of density, performance, power consumption, and endurance. The next generation memory technologies find use cases across consumer electronics, data centers, artificial intelligence, and autonomous driving due to their faster write and read speeds, better scalability, and non-volatility.

The Next Generation Memory Technologies market is estimated to be valued at US$ 4298.1 Mn in 2023 and is expected to exhibit a CAGR of 56.% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The growth of the next generation memory technologies market is majorly driven by continuous advancements in materials engineering and memory architecture. For instance, research underway involves the use of new materials like HfO2 and Ta2O5 for ReRAMs that enable higher scalability and better performance. The 3D XPoint technology developed by Micron and Intel utilizes a novel memory cell design with cross-point architecture arranged in a three-dimensional matrix for higher density. Additionally, growing demand for non-volatile memory from various end-use industries is also fueling market growth. However, high manufacturing costs of these technologies pose a challenge for widespread commercialization.

SWOT Analysis

Strength: Next Generation Memory Technologies have high storage density, low power consumption and enhanced speed. They offer better read/write performance than existing memory technologies. NGMT provide unlimited read write endurance and have better scalability to higher density.

Weakness: Commercialization of these technologies is still in progress. Manufacturing challenges and high development costs are limiting widespread adoption. Requirement of new fabrication processes poses integration challenges with existing chips.

Opportunity: Growing demand for high bandwidth storage solutions from data centers and adoption of IoT edge computing is driving the need for NGMT. Increasing use of AI/ML workloads favor deployment of advanced memory technologies.

Threats: Slow transition from RD to volume manufacturing poses risk of technology obsolescence. Established players in memory market have advantage of existing fabrication infrastructure and customer lock-in limits newcomers.

Key players

Key players operating in the Next Generation Memory Technologies market are Micron Technology, Inc., Fujitsu Ltd., Everspin Technologies, Inc., Winbond Electronics Corporation, SK Hynix Inc., Cypress Semiconductor Corporation, Avalanche Technology, Inc., Adesto Technologies Corporation Inc., and Samsung Electronics Co. Ltd. Major players are investing heavily in RD to commercialize novel memory technologies and gain early mover advantage in this emerging market.

Key Takeaways

The global Next Generation Memory Technologies market is expected to witness high growth, exhibiting a CAGR of 56% over the forecast period, due to increasing demand for high bandwidth storage solutions in data centers and adoption of IoT applications.

North America is currently the dominant region for NGMT market owing to presence of major technology companies and availability of advanced infrastructure for manufacturing.

The Asia Pacific region is expected to grow at the fastest rate owing to rising demand from major economies like China and India. China is pushing investments in semiconductors through initiatives like Made in China 2025 plan. Taiwan and South Korea are also major manufacturing hubs for memory chips and have capabilities to adopt new technologies.