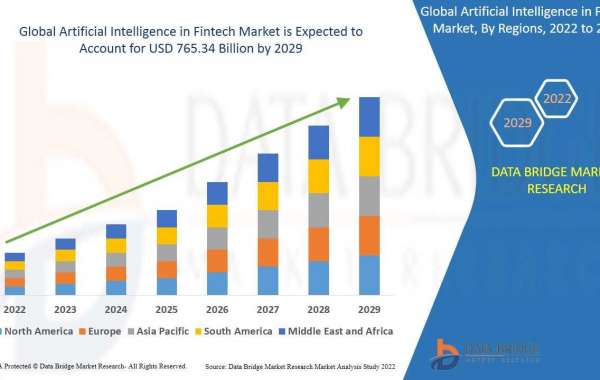

The artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period.

For creating sustainable and profitable business strategies, valuable and actionable market insights are significant for all time. The artificial intelligence in the fintech market research report is right there to serve such needs of businesses and hence analyses the market from top to bottom by considering plentiful of aspects. This marketing report provides an analytical measurement of the main challenges faced by the business currently and in the upcoming years. The artificial intelligence in fintech market document involves key data and information about the ABC industry, emerging trends, product usage, motivating factors for customers and competitors, restraints, brand positioning, and customer behavior.

Download a Sample PDF Copy of this Report to understand the structure of the complete report (Including Full TOC, Table Figures) @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-ai-in-fintech-market

The comprehensive artificial intelligence in fintech market report is an analytical estimation of the key challenges in terms of sales, export/import, or revenue that an organization may have to face in the coming years. The report uses an excellent research methodology that focuses on market share analysis and key trend analysis. For competitive analysis, it considers various strategies of the major players in the market such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others which leads to a rise of their footprints in the market The artificial intelligence in fintech market The artificial intelligence in fintech market research report is sure to help in growing sales with new thinking, new skills, and innovative programs and tools.

Global Artificial Intelligence in Fintech Market Analysis and Size

Artificial intelligence in fintech enables the management of huge volumes of data to derive valuable insights and develops a better understanding of customers and their behavior. A rising number of small and medium-scale end users are increasingly understanding the importance of integrating advanced technologies with financial services. RapidMiner, Inc. (US), SAP SE (Germany), SAS Institute Inc. (US), Microsoft (US), Google, LLC (US), and Hewlett Packard Enterprise Development LP (US) are the major players operating in this market.

Data Bridge Market Research analyses that the artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period. “Cloud" accounts for the largest deployment mode segment in artificial intelligence in the finch market owing to the growing number of small and medium-scale enterprises.

Global Artificial Intelligence in Fintech Market Scope

Artificial intelligence in the fintech market is segmented on the basis of component, deployment mode, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

- Component

- Solutions

- Services

- On the basis of components, artificial intelligence in fintech market is segmented into solutions and services. On the basis of solutions, the market is further segmented into software tools and platforms. On the basis of service, the market is further segmented into managed and professional.

- Deployment mode

- Cloud

- On-Premises

- Based on deployment mode, artificial intelligence in fintech market has been segmented into cloud and on-premises.

- Application

- Virtual Assistant

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Others

- On the basis of application, artificial intelligence in fintech market has been segmented into a virtual assistant, business analytics and reporting, customer behavioural analytics and others.

Artificial Intelligence in Fintech Market Regional Analysis/Insights

The artificial intelligence in fintech market is analysed and market size insights and trends are provided by country, component, deployment mode and application as referenced above.

The countries covered in the artificial intelligence in fintech market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Competitive Landscape and Artificial Intelligence in Fintech Market Share Analysis

The artificial intelligence in fintech market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to artificial intelligence in fintech market.

Some of the major players operating in the artificial intelligence in fintech market are:

- BigML, Inc. (US)

- Cisco Systems, Inc. (US)

- FICO (US)

- Hewlett Packard Enterprise Development LP (US)

- RapidMiner, Inc. (US)

- SAP SE (Germany)

- SAS Institute Inc. (US)

- Microsoft (US)

- Google, LLC (US)

- com Inc. (US)

- IBM (US)

- Intel Corporation (US)

- Amazon Web Services, Inc. (US)

- Inbenta Technologies (US)

- IPsoft (US)

- Nuance Communications (US)

- ComplyAdvantage (UK)

Browse More About This Research Report @ https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Artificial Intelligence in Fintech Market Landscape

Part 04: Global Artificial Intelligence in Fintech Market Sizing

Part 05: Global Artificial Intelligence in Fintech Market by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Get the Full Table of Contents @ https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market

Browse Trending Reports:

https://www.databridgemarketresearch.com/reports/asia-pacific-reverse-logistics-market

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-reverse-logistics-market

https://www.databridgemarketresearch.com/reports/global-rubber-testing-equipment-market

https://www.databridgemarketresearch.com/reports/global-antibiotics-market

https://www.databridgemarketresearch.com/reports/global-micro-electro-mechanical-system-mems-market

https://www.databridgemarketresearch.com/reports/global-non-destructive-testing-equipment-market

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies globally and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

Contact Us: -

Data Bridge Market Research

US: +1 888 387 2818

United Kingdom: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: – sopan.gedam@databridgemarketresearch.com