Take control of your finances and eliminate debt with Thrivingkoala.com Debt Payoff Tracker. Our easy-to-use tool helps you budget, track your progress, and stay motivated as you reach your financial goals.

Presentation

Overseeing individual budgets can be an overwhelming undertaking, however, with the right instruments, it turns into a breeze. Month-to-month spending plan formats and bookkeeping sheets are strong assets that assist people with assuming command over their monetary prosperity. From following costs and bills to making arrangements for the future, these apparatuses give significant bits of knowledge into spending examples, investment funds, and monetary objectives. In this article, we will investigate the advantages and elements of different spending plan formats, including the Month to monthly Financial plan Calculation sheet, Yearly Financial plan Organizer, Bill Organizer Accounting sheet, Monthly Bill Tracker to month Bill Tracker, Individual accounting Tracker, and Financial plan Google Sheets.

Month to month Financial plan Bookkeeping sheet

A Month to month Financial plan Bookkeeping sheet is a thorough device that helps people coordinate and dealing with their funds consistently. This accounting sheet ordinarily incorporates segments for money, costs, reserve funds, and obligations. Clients can include their different types of revenue and rundown their repetitive costs like leases, utilities, food, transportation, and diversion. The bookkeeping sheet will naturally work out the absolute pay, all out costs, and the subsequent excess or shortage. By consistently refreshing this sheet, clients gain important bits of knowledge about their monetary well-being and distinguish regions where they need to scale back or increment reserve funds.

Yearly Financial plan Organizer

While a Month to monthly Budget Spreadsheet Finamonthly plan Calculation sheet centers around transient monetary preparation, a Yearly Financial plan Organizer takes a more extensive view. It permits clients to make an exhaustive financial plan all year long, consolidating both normal costs and once occasions like getaways, getaways buys, or clinical costs. A Yearly Financial plan Organizer is particularly useful for those with fluctuating livelihoods or who need to lay out long-haul objectives. It energizes trained saving and monetary preparation by giving an outline of the whole year's monetary standpoint.

Charge Organizer Calculation sheet

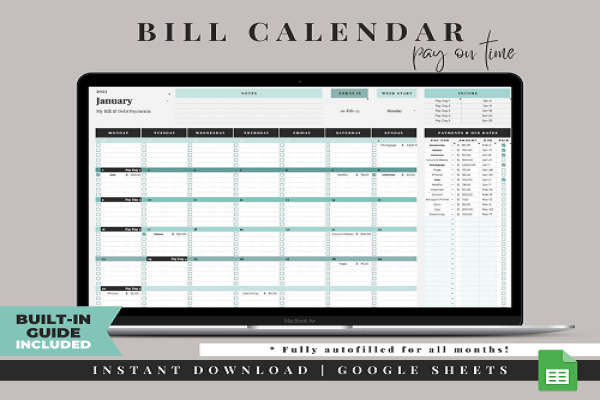

Late bill installments can prompt pointless expenses and stress. A Bill Organizer Bookkeeping sheet assists clients with keeping away from such circumstances by giving a concentrated area to follow every one of their bills and their duets can set up updates or cautions to guarantee they never miss an installment. Furthermore, this accounting sheet can be coordinated with other financial plan layouts to figure out repeating bill outs while working out month-to-month expenses. Keeping steady over bills cultivates monetary obligation and further develops FICO ratings.

Month-to-month Bill Tracker

A Month to month Bill Tracker supplements the Bill Organizer Calculation sheet by permitting clients to record the genuine installment dates and the affirmation quantities of each bill paid. This degree of detail empowers clients to screen their installment history, guaranteeing all accounts are cleared immediately. Besides, it fills in as a convenient reference if there should be an occurrence of any installment errors or debates. With a Month to month Bill Tracker, clients gain an unmistakable image of their installment propensities and can make vital changes for better monetary preparation.

Individual accounting Tracker

An Individual accounting Tracker is a widely inclusive instrument that joins planning, cost following, objective setting, and total assets computation. It fills in as a monetary dashboard, offering a comprehensive perspective on one's monetary well-being. With highlights like diagrams, outlines, and perceptions, clients can rapidly survey their advancement toward monetary objectives and distinguish patterns. This integral asset works with complete monetary preparation and enables clients to make informed choices about their cash.

Spending plan Google Sheets

In the advanced age, cloud-based devices are progressively well-known for their benefit and availability. Financial plan Google Sheets influence the force of Google's cloud-based stage, permitting clients to get to their spending plan formats from any place with a web association. Different clients can team up on a similar sheet simultaneously, making it ideal for couples or flatmates overseeing shared costs. Also, Google Sheets offer different additional items and reconciliation choices, further improving the planning experience.

End

Monetary administration is a pivotal part of our day-to-day routines, and month-to-month spending plan layouts and calculation sheets give significant help with accomplishing monetary soundness and meeting our objectives. From following costs to anticipating the future, these devices offer a large number of elements custom-made for various monetary necessities. By embracing at least one of these planning devices, people can assume responsibility for their funds, ease monetary pressure, and work towards building a safe monetary future. Whether it's a basic Month to monthly Spending plan Calculation sheet or an exhaustive Individual budget Tracker, these assets are here to enable clients on their excursion to monetary achievement.

For more info:-