Introduction

In the dynamic landscape of the financial sector, banks face an ever-evolving set of challenges, including stringent regulations, fierce competition, technological disruptions, and shifting customer expectations. In this complex environment, the importance of expert guidance cannot be overstated. Bank consulting firms play a pivotal role in helping financial institutions navigate these challenges and achieve sustainable growth. This article delves into the vital functions and benefits of bank consulting firms, shedding light on how they contribute to enhancing banking success.

Identifying Opportunities and Threats

Bank consulting firms possess a wealth of industry knowledge, keeping abreast of the latest trends, market dynamics, and emerging risks. By conducting thorough analyses of the banking landscape, these firms can identify potential opportunities for growth and expansion, as well as impending threats that could adversely impact a bank's profitability and stability. Armed with this information, banks can make informed strategic decisions to capitalize on opportunities and mitigate risks.

Compliance and Regulatory Expertise

Adhering to an ever-increasing array of regulations is a significant challenge for banks. Failure to comply can result in hefty fines and reputational damage. Bank consulting firms specialize in understanding and interpreting complex regulatory requirements, ensuring that banks remain compliant at all times. They provide guidance in implementing robust compliance frameworks, conducting risk assessments, and adopting best practices, safeguarding the bank's reputation and maintaining the trust of customers and regulators alike.

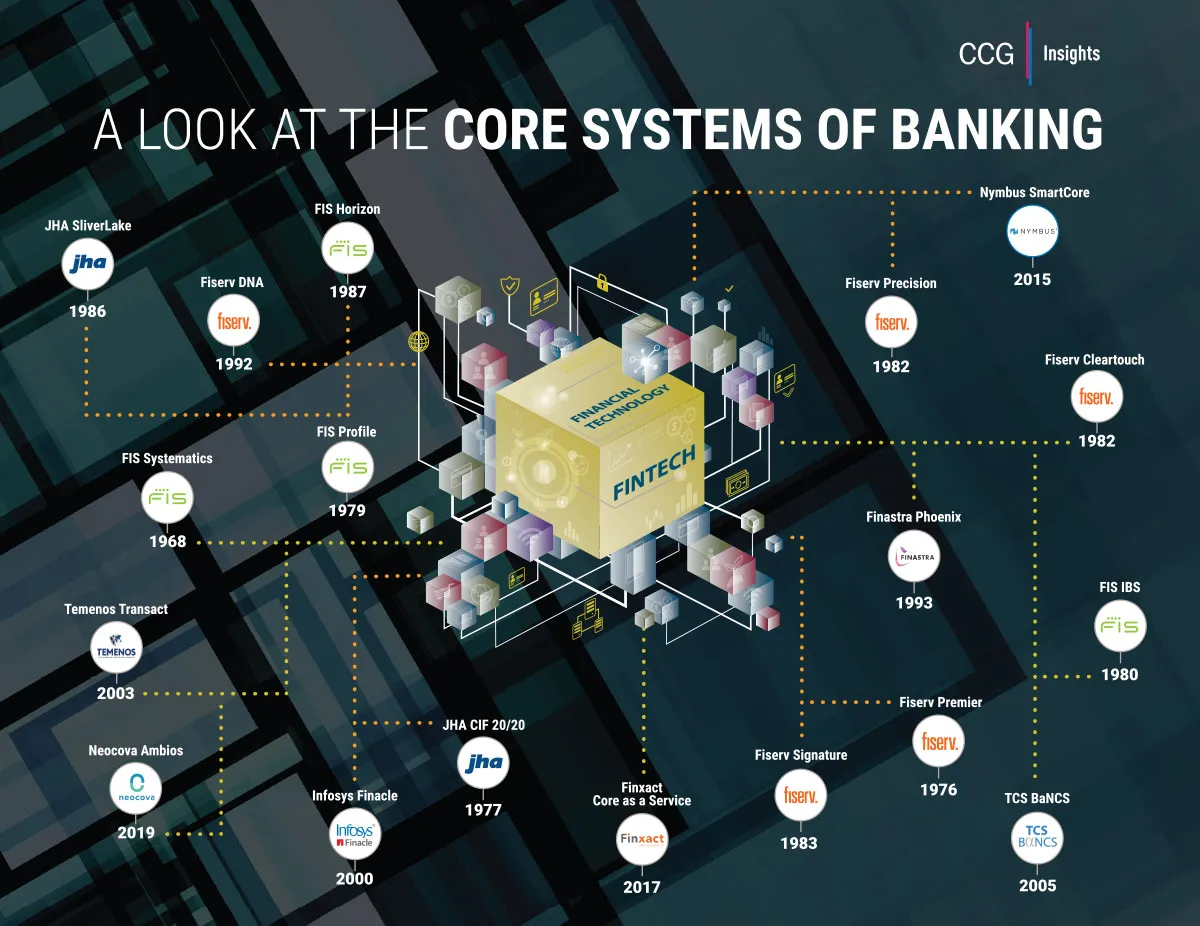

Technology Integration and Innovation

The digital revolution has revolutionized the banking industry, ushering in new technological advancements such as artificial intelligence, blockchain, and data analytics. Bank consulting firms are at the forefront of these innovations, assisting banks in embracing digital transformation. They help institutions integrate cutting-edge technologies to streamline operations, enhance customer experience, and develop innovative financial products and services. Embracing these technological solutions enables banks to stay competitive and relevant in an increasingly tech-driven landscape.

Process Optimization and Efficiency

Inefficiencies within a bank's processes can lead to unnecessary costs, delays, and reduced customer satisfaction. Consulting firms conduct thorough process evaluations, identifying bottlenecks and recommending process improvements. Through process optimization, banks can streamline operations, enhance productivity, and achieve cost savings, thereby improving their overall efficiency and bottom line.

Risk Management and Stress Testing

Effective risk management is vital for maintaining financial stability. Bank consulting firms assist banks in developing robust risk management frameworks and stress testing methodologies. By simulating adverse scenarios, banks can assess their resilience and identify potential vulnerabilities. Armed with these insights, banks can proactively address risk exposures and bolster their ability to weather economic downturns and crises.

Market Expansion and Mergers Acquisitions (MA)

In an era of globalization, banks seek opportunities to expand their geographic reach and diversify their offerings through strategic partnerships and MA deals. Bank consulting firms play a crucial role in conducting due diligence, valuations, and risk assessments for potential mergers and acquisitions. Their expertise enables banks to make well-informed decisions, ensuring successful integrations and long-term growth.

Conclusion

Bank consulting firms serve as invaluable partners for financial institutions seeking to thrive in an ever-evolving banking landscape. From identifying opportunities and threats to providing compliance expertise and embracing technological innovations, these firms offer comprehensive solutions to enhance banking success. As banks face an array of challenges, enlisting the support of a reputable bank consulting firm can prove to be a strategic investment that pays dividends in achieving sustainable growth and maintaining a competitive edge.

For additional data, visit our site