Key Market Insights

- The current market landscape features the presence of over 240 CDMOs and in-house players that are engaged in the manufacturing of cell therapies, across various scales of operation

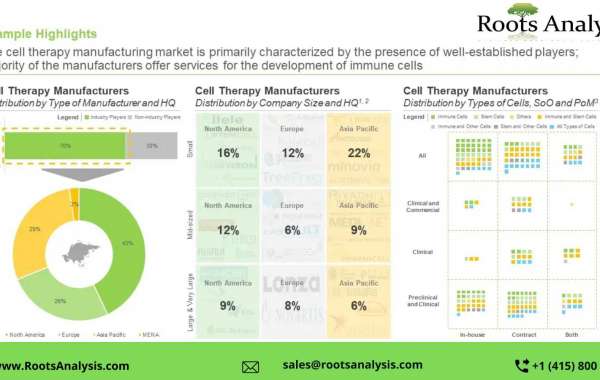

- The cell therapy manufacturing market is primarily characterized by the presence of well-established players; majority of the manufacturers offer services for the development of immune cells

- Owing to the increasing demand for cell therapies, players have been expanding their manufacturing capabilities across different scales of operation; the US has emerged as the most prominent industry headquarters

- The number of partnerships inked in this domain demonstrates the growing interest of players in the cell therapy manufacturing market; majority of the deals have been done for the clinical manufacturing of T cell therapies

- In pursuit of obtaining a competitive edge and to eventually establish themselves as one-stop shops, stakeholders are actively consolidating their capabilities related to cell therapies through mergers and acquisitions

- Industry players are making extensive efforts to expand their existing capacities and capabilities for both clinical and commercial manufacturing of cell therapies

- Our proprietary total cost of ownership model suggests an informed estimate of direct and indirect expenses while setting up a contract manufacturing facility in different regions, over a span of 20 years

- Around 50% of the big pharma initiatives have been undertaken for the purpose of expanding their portfolio and capabilities through partnerships and collaborations; of these, 70% initiatives were undertaken post 2019

- Over 70 automation technologies are currently available for the manufacturing of cell therapies, sidestepping the involvement of manual efforts; this is likely to attract the interest of stakeholders in the cell therapy domain

- More than 80% of the current installed manufacturing capacity is presently being utilized for commercial scale manufacturing of cell therapies; maximum capacity is installed in facilities based in North America

- In 2035, close to 20% of the demand for cell therapies is likely to be generated by autologous T cell therapies for the treatment of patients suffering from various oncological disorders

- The global cell therapies manufacturing market is expected to grow at a CAGR of 12%, till 2035; T cell therapies and stem cell therapies capture more than 85% of the current market share

- The overall opportunity is expected to be well distributed across multiple segments; specifically, in the long term, commercial scale manufacturing is likely to drive the market’s growth

Table of Contents

- PREFACE

1.1. Scope of the Report

1.2. Market Segmentations

1.3. Research Methodology

1.4. Key Questions Answered

1.5. Chapter Outlines

- EXECUTIVE SUMMARY

2.1. Chapter Overview

- INTRODUCTION

3.1. Chapter Overview

3.2. Introduction to Cell-based Therapies

3.3. Overview of Cell Therapy Manufacturing

3.4. Cell Therapy Manufacturing Models

3.5. Scalability of Cell Therapy Manufacturing Processes

3.6. Types of Cell Therapy Manufacturers

3.7. Key Challenges for Manufacturing Cell Therapies

3.8. Key Factors Influencing Cell Therapy Manufacturing

3.9. Automation of Cell Therapy Manufacturing Processes

3.10. Cell Therapy Manufacturing Supply Chain

3.11. Future Perspectives

- MARKET OVERVIEW

4.1. Chapter Overview

4.2. Cell Therapy Manufacturing (Industry Players): Overall Market Landscape

4.3. Cell Therapy Manufacturing (Non-Industry Players): Overall Market Landscape

- REGULATORY LANDSCAPE

5.1. Chapter Overview

5.2. Current Scenario

5.3. Regulatory Accreditations for Cell Therapy Manufacturing

5.4. Summary of Guidelines for Clinical-Stage Manufacturing of Cell Therapies

5.5. Existing Challenges to Clinical-Stage Manufacturing of Cell Therapies

- ROADMAPS FOR OVERCOMING CHALLENGES

6.1. Chapter Overview

6.2. Roadmap for the US

6.3. Roadmaps for Other Geographies

- AUTOMATION TECHNOLOGIES FOR CELL THERAPY MANUFACTURING

7.1. Chapter Overview

7.2. Automation of Cell Therapy Manufacturing Processes

7.3. Growth Drivers and Roadblocks

7.4. Case Studies

7.5. GMP-in-a-Box

7.6. List of Automated and Closed Cell Therapy Processing Systems

7.7. Comparative Analysis of Manual and Automated Processes

- PROFILES: INDUSTRY PLAYERS

8.1. Chapter Overview

8.2. Service Providers in North America

8.3. Service Providers in Europe

8.4. Service Providers in Asia Pacific

- PROFILES: NON-INDUSTRY PLAYERS

9.1. Chapter Overview

9.2. Center for Cell and Gene Therapy, Baylor College of Medicine

9.3. Centre for Cell Manufacturing Ireland, National University of Ireland

9.4. Clinical Cell and Vaccine Production Facility, University of Pennsylvania

9.5. Guy’s and St. Thomas’ GMP Facility, Guy’s Hospital

9.6. Laboratory for Cell and Gene Medicine, Stanford University

9.7. Molecular and Cellular Therapeutics, University of Minnesota

9.8. Newcastle Cellular Therapies Facility, Newcastle University

9.9. Rayne Cell Therapy Suite, King’s College London

9.10. Scottish National Blood Transfusion Services Cellular Therapy Facility, Scottish Centre for Regenerative Medicine

9.11. Sydney Cell and Gene Therapy

- ROLE OF NON-PROFIT ORGANIZATIONS

10.1. Chapter Overview

10.2. Cell Therapy Manufacturing: Non-Profit Organizations

10.3. Cell Therapy Manufacturing: International Societies

- CLINICAL TRIAL ANALYSIS

11.1. Chapter Overview

11.2. Scope and Methodology

11.3. Cell Therapies: Clinical Trial Analysis

- PARTNERSHIPS AND COLLABORATIONS

12.1. Chapter Overview

12.2. Partnership Models

12.3. Cell Therapy Manufacturing: List of Partnerships

12.4. Analysis by Type of Cell Manufactured

12.5. Analysis by Scale of Operation

12.6. Analysis by Region

12.7. Most Active Players: Analysis by Number of Partnerships

12.8. Cell Therapy Manufacturing: List of Mergers and Acquisitions

- RECENT EXPANSIONS

13.1. Chapter Overview

13.2. Cell Therapy Manufacturing: List of Expansions

- BIG PHARMA INITIATIVES

14.1. Chapter Overview

14.2. Big Pharma Players: List of Cell Therapy Manufacturing Focused Initiatives, 2017-2022

14.3. Competitive Benchmarking of Big Pharmaceutical Players

- CAPACITY ANALYSIS

15.1. Chapter Overview

15.2. Key Assumptions and Methodology (Industry Players)

15.3. Key Assumptions and Methodology (Non-Industry Players)

15.4 Concluding Remarks

- DEMAND ANALYSIS

16.1 Chapter Overview

16.2 Scope and Methodology

16.3 Global Demand for Cell Therapy Manufacturing

16.4 Global Clinical Demand for Cell Therapy Manufacturing

16.5. Global Commercial Demand for Cell Therapy Manufacturing

- COST PRICE ANALYSIS

17.1. Chapter Overview

17.2. Factors Contributing to the High Price of Cell Therapies

17.3. Pricing Models for Cell Therapies

17.4. Cell Therapy Cost Optimization

17.5. Role of Cell Therapy Contract Manufacturing Organizations

17.6. Reimbursement-related Considerations for Cell Therapies

- MAKE VERSUS BUY DECISION MAKING FRAMEWORK

18.1. Chapter Overview

18.2. Assumptions and Key Parameters

18.3. Cell Therapy Manufacturing: Make versus Buy Decision Making

18.4. Concluding Remarks

- TOTAL COST OF OWNERSHIP FOR CELL THERAPY MANUFACTURING ORGANIZATIONS

19.1. Chapter Overview

19.2. Key Parameters

19.3. Assumptions and Methodology

19.4. Sample Dataset for the Estimation of Total Cost of Ownership

19.5. Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations, Y0-Y20

19.6 Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations: Analysis by CAPEX and OPEX, Y0 and Y20

- MARKET SIZING AND OPPORTUNITY ANALYSIS

20.1. Chapter Overview

20.2. Scope of the Forecast

20.3. Input Data and Key Assumptions

20.4. Forecast Methodology

20.5. Global Cell Therapy Manufacturing Market, 2022-2035

20.6. Cell Therapy Manufacturing Market for Commercial Scale Manufacturing

20.7. Cell Therapy Manufacturing Market for Clinical Scale Manufacturing

- KEY INSIGHTS

21.1. Chapter Overview

21.2. Cell Therapy Manufacturing: Grid Analysis

21.3. Cell Therapy Manufacturing: Logo Landscape

21.4. Cell Therapy Manufacturing: World Map Representation based on Location of Manufacturing Facilities

- SWOT ANALYSIS

22.1. Chapter Overview

22.2. Strengths

22.3. Weaknesses

22.4. Opportunities

22.5. Threats

22.6. Comparison of SWOT Factors

- CONCLUDING REMARKS

23.1. Chapter Overview

- SURVEY ANALYSIS

24.1. Chapter Overview

24.2. Analysis by Designation of Respondents

24.3. Analysis by Type of Cell Therapy

24.4. Analysis by Scale of Operation

24.5. Analysis by Source of Cells

24.6. Analysis by Type of Cell Culture System Used

24.7. Analysis by Availability of Fill / Finish Services

- INTERVIEW TRANSCRIPTS

- APPENDIX 1: TABULATED DATA

- APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/cell-therapy-manufacturing/285.html

Learn from experts: do you know about these emerging industry trends?

Investment Opportunities in Women’s Digital Health

Liposomes Development: Service Providers Landscape

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091