The soul of entrepreneurialism is essentially as American as baseball and fruity dessert. It's likewise a main impetus in our country's economy. The Private company Organization (www.sba.gov) states that little firms make 99.7% out of all business firms, yet insights show that 69% of new organizations normally endure two years and 51% of those endure just five years. Too, at this point we've all heard that absence of funds is the main reasons these organizations close. For example, "Just the solid make due," and cash is your raft! Can we just be look at things objectively for a minute. In the event that you don't have the cash to keep your business alive, the situation is anything but favorable for you.

However, try not to worry! Acquiring the capital expected to remain above water is out there, even in the present financial environment, however you must be sufficiently astute to track down it! I'm going to share three (out of many) ways of acquiring funding for your business (in no specific request of significance):

1. Confidential financial backers: At times the most ideal way to acquire the cash you really want to develop is essentially by inquiring. I don't mean in a, "Pretty if it's not too much trouble, kind of way. Obviously, serious confidential financial backers/financial speculators/private supporters need to see a strong marketable strategy illustrating your monetary necessities, your technique for development, and your technique for reimbursement. It additionally helps assuming you are including your very own portion assets into the dare to show the financial backer that you are sharing the gamble of expected disappointment.

"In this way, where do I track down these financial backers?" Extraordinary inquiry! The are surrounding you! A confidential financial backer might a relative, nearby at any point neighbor, church part, or the individual close to you in the lift. The fact of the matter is: on the off chance that you can move somebody with the cash-flow to put resources into your sound thought, you're all set! The keys to this achievement are the trust in your strategic agreement and the information on your business thought.

2. Expressly ensuring business credit: This by a long shot is the most un-alluring, due to the incorporation of credit. Moreover, the typical American has credit far under 680, which makes it almost difficult to by and by ensure any sort of business funding. Assuming you're one of the fortunate ones, you can utilize your great credit ratings as a "ensure" to banks that all cash got will be reimbursed, or you will confront the outcomes of having it report on your own credit report.

"Along these lines, consider the possibility that I don't have great credit?" Another extraordinary inquiry! Do you know somebody with a decent credit score? In many cases, people will accomplice up by just adding this "credit accomplice" onto the company and getting supporting involving them as the individual underwriter. Yet again this includes a strong strategy for reimbursement and, surprisingly, more trust. Try to draft the whole organization recorded as a hard copy and never into this sort of Understanding without all gatherings included knowing the possible dangers in general.

3. Matured/Rack organizations: This is certainly not a groundbreaking thought. Banks are more inclined to stretch out acknowledge to an organization for 5+ years worth of history versus an organization that is 5 months old. That gives them more confirmation that they're working with somebody that has dependability and life span. Comprehend that just having a matured company doesn't ensure the capacity of getting financing. Try not to allow these tricksters to trick you into figuring you can purchase a partnership that as of now has $1,000,000 worth of accessible financing that you can purchase for $500. Does that try and seem OK? Could Donald Best sell a $20,000,000 organization for peanuts? Obviously not!

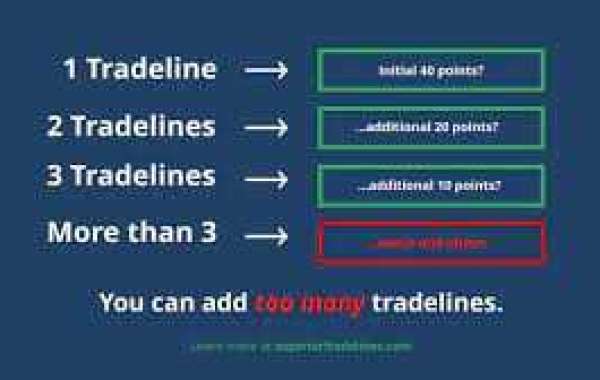

I have found the best arrangement is to purchase enterprises and add business tradelines to them. How would you do that? Indeed, that is for you to explore. In any case, you should constantly ensure that you work with authentic sources. Is it simple? No, however achievement won't ever be.

All things considered, it isn't difficult to lay out and grow a productive business. You simply must have the right devices to make due, and cash is certainly one of those instruments. Outfit yourself with the skill to acquire the business capital you really want when it counts.

web : tradeline packages