Members of credit unions pool their assets to provide loans and other financial services to one another. Banks are for-profit institutions that are controlled by a board and stockholders who have varying amounts of influence over the bank's operations based on the total value of their shares. Customers of a bank who do not own stock in the company do not own a financial interest in the bank. Unlike banks, credit unions do not pay dividends to an outside group of stockholders and operate under a "one vote per member" system, regardless as to how much money the member has in the organization. A common misconception about credit unions is, because they are local financial institutions, their reach is limited. Credit unions bring the "People Helping People" philosophy to life by pooling resources and using networks such as the Co-Op ATM network to provide members with global access to their funds.

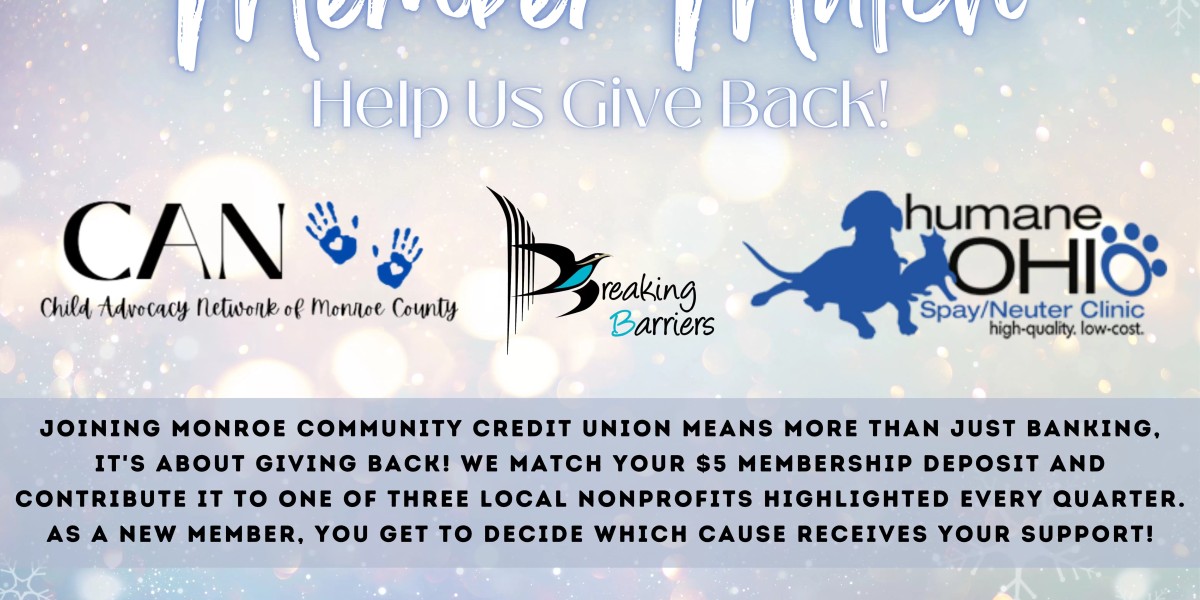

At a credit union, you are given the title of “member” and not “customer” because of the nature of your relationship with the institution. Because credit unions are member owned financial institutions, your initial deposit of $5.00 into a share account is your 'buy in' to the cooperative. This $5.00 share is often compared to minimum deposit requirements at a bank, which are usually somewhere between $50.00-$100.00, but they are very different from one another. Owning a share of a credit union gives you a vote at annual meetings and allows you to voice your opinion on who should sit on the board of directors, while opening deposit requirements at banks are imposed by their stockholders and do not give you a voice in how the business is run.