The Carbon Credit Trading Platform Market is gaining traction as governments, corporations, and industries worldwide look to offset their carbon emissions through trading systems. These platforms facilitate the buying and selling of carbon credits, a tool designed to incentivize companies to reduce greenhouse gas emissions and promote environmental sustainability. The market’s growth is driven by increasing governmental and corporate mandates aimed at achieving net-zero emissions and addressing climate change challenges.

Read Complete Report Details of Carbon Credit Trading Platform Market: https://www.snsinsider.com/reports/carbon-credit-trading-platform-market-2794

Market Segmentation

By Type

Voluntary Carbon Market

- In this market, carbon credits are purchased voluntarily by companies or individuals to offset their emissions. The voluntary market is particularly popular among corporations looking to enhance their sustainability image or meet self-imposed environmental targets.

Regulated Carbon Market

- Operates under government-imposed regulations that require companies to either reduce their emissions or buy carbon credits to comply with environmental laws. These markets are typically larger and more structured, with caps on emissions and a set number of credits

By System Type

Cap & Trade

- In a cap-and-trade system, a cap is set on the total level of carbon emissions, and companies are issued carbon credits. Companies that reduce emissions can trade their excess credits to others. This system is often used in regulated markets, such as the European Union Emission Trading Scheme (EU ETS).

Baseline & Credit

- This system allows companies to earn credits by demonstrating emissions reductions from a baseline scenario. These credits can then be traded. It is more flexible than cap-and-trade and often used in voluntary markets or specific regulatory frameworks.

By End-Use

Utilities

- Utility companies are large participants in carbon credit trading due to their high emissions levels from power generation. Trading platforms allow them to buy credits to meet compliance requirements.

Industrial

- Industries with significant emissions, such as manufacturing and cement production, use carbon credit platforms to offset emissions and meet regulatory standards.

Aviation

- Aviation is one of the most carbon-intensive sectors. Airlines and aviation companies are increasingly involved in carbon credit trading to meet emissions reduction goals and avoid penalties.

Petrochemical

- Petrochemical industries are major contributors to greenhouse gas emissions. Carbon credit trading helps these industries offset emissions as part of their compliance strategies.

Energy

- Energy producers, particularly those relying on fossil fuels, engage in carbon credit trading to comply with environmental regulations and to support their sustainability initiatives.

Others

- This category includes sectors like transportation, logistics, and agriculture, all of which are increasingly adopting carbon offset programs and using carbon credit platforms.

By Region

North America

- The region is seeing substantial growth in carbon credit trading platforms due to policies like the U.S. carbon markets and the Canadian carbon pricing mechanism. Corporate sustainability goals further fuel market demand.

Europe

- Europe is home to the EU Emission Trading System, one of the largest regulated carbon markets globally. The region’s ambitious carbon reduction targets and ongoing green transitions make it a key market for carbon credit trading platforms.

Asia-Pacific

- Countries like China, Japan, and India are ramping up their carbon trading systems. The region is experiencing rapid industrialization and is poised to be a major player in the global carbon credit trading market.

Middle East & Africa

- The market is in a nascent stage but growing, driven by oil and gas companies in the Middle East looking to meet emissions reduction commitments. Africa’s developing carbon markets also offer growth potential.

Latin America

- Latin America is increasingly engaged in the voluntary carbon market, with companies across the region participating in sustainability efforts and carbon credit trading platforms.

Market Drivers

Government Regulations & Climate Policies

- Many governments are instituting policies that impose carbon taxes or emissions caps, boosting the demand for carbon credit platforms.

Corporate Sustainability Targets

- Many corporations are adopting sustainability goals, including achieving carbon neutrality, which creates demand for carbon credits.

Rising Awareness of Climate Change

- Growing awareness about climate change and the need for carbon offset programs has significantly driven market growth.

Technological Advancements

- The growth of blockchain and AI technologies is improving the transparency and efficiency of carbon credit trading platforms.

MarKet Trends

Blockchain Integration

- Blockchain technology is being integrated into carbon credit platforms for transparent, tamper-proof transactions and to enhance market integrity.

Rise of Digital Platforms

- Increased use of digital and online platforms for trading carbon credits, making it more accessible for businesses and individuals.

Increased Corporate Participation

- Many corporations are voluntarily participating in carbon markets to reduce their carbon footprints and demonstrate their commitment to sustainability.

Market Outlook

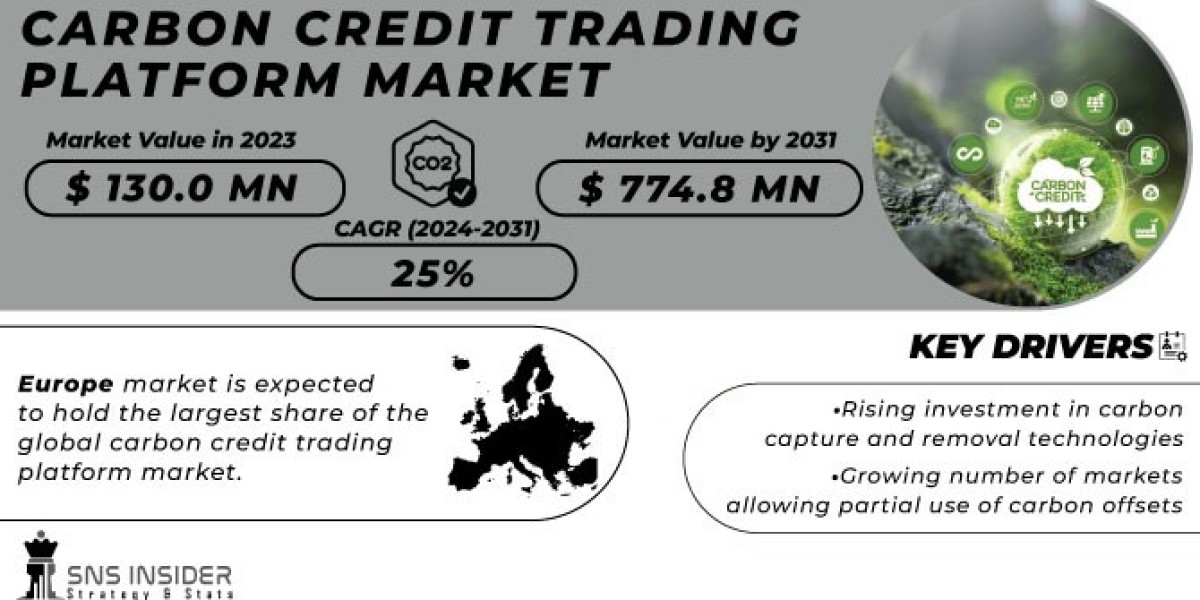

The Carbon Credit Trading Platform Market is poised for significant growth in the coming years, driven by increasing regulatory pressure, corporate sustainability targets, and technological innovation. With the global push toward reducing carbon emissions and the transition to a low-carbon economy, carbon credit trading platforms will continue to play a critical role in achieving these goals.

From 2024 to 2031, the market is expected to expand as both voluntary and regulated markets mature across various regions, especially in North America, Europe, and Asia-Pacific, offering substantial opportunities for investors and platform providers.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand — Head of Business Development & Strategy

info@snsinsider.com

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)