Current Treatment Paradigm and Market Dynamics

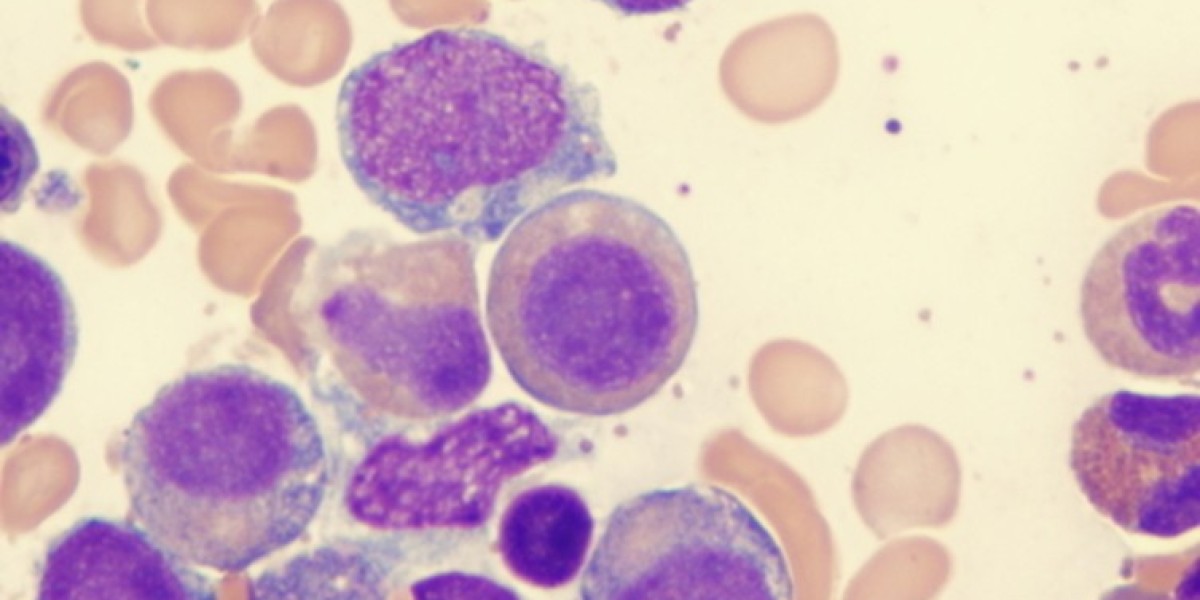

Myelodysplastic syndromes (MDS) are a group of blood cancers caused by poorly formed or dysfunctional blood cells in the bone marrow. There are over 10,000 new cases of MDS diagnosed in the U.S. each year while Europe sees approximately 15,000-20,000 new cases annually. Though relatively rare compared to other cancers, the number of MDS cases is steadily increasing due to the aging global population.

The primary goals of U.S., Europe, and China myelodysplastic syndrome (MDS) treatment market treatment are to reduce complications from low blood cell counts, reduce the risk of progression to acute myeloid leukemia (AML), and improve quality of life and survival. Treatment options depend on various factors including the subtype or risk level of MDS, the age and health of the patient, presence of certain genetic mutations, and tendency of the disease to progress to AML.

The standard first-line U.S., Europe, and China Myelodysplastic Syndrome (MDS) Treatment patients who are younger and healthier is drug therapy with erythropoiesis-stimulating agents (ESAs) or colony-stimulating factors to boost red blood cell and white blood cell production. High-risk MDS patients may receive hypomethylating agents such as azacitidine or decitabine, which can lengthen survival duration. Stem cell transplantation may be considered for younger lower-risk MDS patients or high-risk patients in remission.

The U.S. represents the largest MDS treatment market currently valued at over $1.2 billion annually and is expected to grow at a compound annual growth rate of 6-8% through 2027 driven by an aging population and rising adoption of novel drug therapies. Europe trails the U.S. with a market size of around $800 million while China's market is estimated at $200 million currently but growing rapidly.

U.S. Treatment Landscape

The U.S. Food and Drug Administration (FDA) has approved several drug therapies for MDS over the past 15 years expanding treatment options. In addition to ESAs approved in the 1990s, the hypomethylating agents azacitidine and decitabine were approved in 2004 and 2006 respectively, representing a major advance for higher-risk MDS.

Several targeted therapies have since entered the market to treat genetically defined subsets of MDS. In 2012, the FDA approved Vidaza (azacitidine) for all MDS subtypes including higher-risk disease based on improved overall survival compared to conventional care regimens. Additional approvals include Daurismo (glasdegib) in 2018 and Tibsovo (ivosidenib) in 2019 as well as Rydapt (midostaurin) for FLT3 mutation-positive MDS in 2017.

Stem cell transplantation remains an important treatment option for suitable MDS patients. Advances in transplant techniques and supportive care have helped extend eligibility to older and less healthy patients. U.S. transplant centers routinely perform over 10,000 hematopoietic cell transplants annually including for MDS. Use of reduced-intensity conditioning regimens where intensive chemotherapy is reduced or omitted has allowed transplantation in older or less fit MDS patients.

Ongoing research aims to develop new targeted drugs and cellular therapies as well as improve outcomes from existing therapies. Several new drug candidates including inhibitors targeting IDH, EZH2, BCL-2 and IDO are in clinical testing for MDS. Chimeric antigen receptor (CAR) T-cell therapies targeting specific leukemic antigens also show promise. With multiple approved and investigational treatment options available, the large U.S. market value is expected to rise steadily in coming years.

Treatment Paradigm of U.S., Europe, and China Myelodysplastic Syndrome (MDS) Treatment

The availability and utilization of MDS therapies generally parallels the U.S. across major European countries due to similar health care systems and regulatory agencies. However, pricing pressures and reimbursement challenges unique to individual countries impact drug access and utilization.

Hypomethylating agents azacitidine and decitabine were first approved in Europe in 2007 and are now approved in over 20 European countries. Azacitidine is reimbursed in most markets while decitabine faces restrictive use in some countries. Additional targeted therapies approved in both the U.S., Europe, and China myelodysplastic syndrome (MDS) treatment market for specific MDS patient subgroups include Daurismo, Tibsovo and Rydapt.

A recent meta-analysis showed improved overall survival in Europe following approvals of hypomethylating agents, indicating their widespread adoption. According to a global survey, azacitidine was listed among preferred first-line treatment options by 85% of European physicians polled. However, restricted public drug reimbursement policies have led to underutilization concerns in some Eastern European markets.

Stem cell transplantation activity is robust across major transplant centers in Western Europe. Over 5,000 allogeneic transplants are performed annually for hematologic malignancies including MDS across European transplant networks. Similar to the U.S., reduced-intensity conditioning regimens have allowed safer procedures for less fit older patients. Additionally, the use of donor lymphocyte infusions as post-transplant immunotherapy helps prevent relapse.

The European market represents over a third of global MDS sales and estimated to exceed $800 million driven by national reimbursement of standard therapies. Ongoing clinical trials evaluate newer agents as well as combination regimens with the aim to improve responses, delay disease progression and survival.

Get More Insights on U.S., Europe, and China Myelodysplastic Syndrome (MDS) Treatment

Select the language you're most comfortable with-

About Author-

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals. (https://www.linkedin.com/in/ravina-pandya-1a3984191)