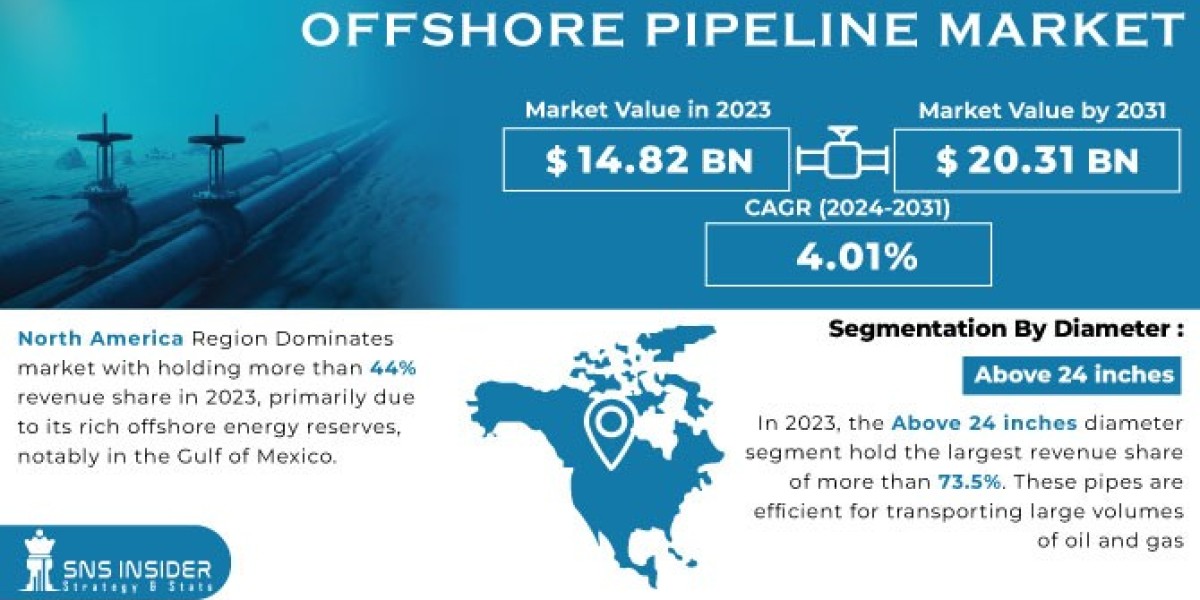

The Offshore Pipeline Market size was valued at USD 14.82 Bn in 2023 and is expected to reach USD 20.31 Bn by 2031 with a growing CAGR of 4.01% over the forecast period 2024–2031.

Offshore pipelines are vital for the global energy market, allowing for efficient transport of oil, natural gas, and other products from offshore production fields to onshore facilities. As the energy sector increasingly moves to offshore drilling to meet the growing demand, reliable pipeline infrastructure has become essential. Offshore pipelines face extreme conditions, including high pressures, deepwater currents, and environmental risks, driving demand for high-quality materials and advanced construction techniques.

Request Sample Report@ https://www.snsinsider.com/sample-request/2847

Key technologies in offshore pipelines include corrosion-resistant materials, remote monitoring systems, and advancements in installation methods, making pipelines safer and more durable. This push for reliability is crucial for stakeholders aiming to minimize environmental impact and optimize operational efficiency.

Key Market Drivers

- Rising Offshore Energy Demand: Growing energy demand, coupled with declining onshore reserves, is pushing countries and companies to expand offshore oil and gas exploration, creating significant demand for offshore pipeline infrastructure.

- Infrastructure Modernization: Aging offshore pipeline infrastructure is being replaced or upgraded to ensure safety, meet regulatory standards, and improve efficiency.

- Technological Advancements: New materials and technologies that extend pipeline lifespan, improve leak detection, and reduce installation costs are gaining traction, especially in deepwater and ultra-deepwater projects.

- Increased Natural Gas Demand: As natural gas becomes a preferred energy source due to its cleaner-burning properties, pipelines are increasingly constructed to transport LNG from offshore production sites to shore.

- Growing Renewable Offshore Energy: Offshore wind and other renewable energy sources require infrastructure to transport energy back to the mainland, expanding pipeline usage beyond traditional hydrocarbons.

Market Segmentation

The Offshore Pipeline Market is segmented by product type, diameter, application, and region.

By Product Type

- Oil Pipeline: Primarily transporting crude oil from offshore wells to onshore processing facilities, oil pipelines are designed to withstand high pressure and prevent leaks over long distances.

- Gas Pipeline: With natural gas demand rising, gas pipelines are a major focus in offshore infrastructure, transporting LNG and gas from production platforms to onshore facilities.

- Refined Product Pipeline: These pipelines transport processed products such as gasoline and diesel, with a focus on corrosion resistance and leak prevention.

- Others: Including water injection lines and carbon dioxide pipelines, this category is growing as fields require additional injection or storage services.

By Diameter

- Below 24 inches: Smaller diameter pipelines are often used for shorter distances or in shallower waters and are commonly utilized in certain gas transportation applications.

- 24–36 inches: Medium diameter pipelines strike a balance between capacity and pressure handling, commonly used in various offshore applications.

- Above 36 inches: Large diameter pipelines handle substantial volumes and are essential for major transport routes across long distances or deepwater projects.

Buy a Complete Report of Offshore Pipeline Market 2024–2031@ https://www.snsinsider.com/checkout/2847

By Application

- Transportation: Offshore pipelines for transportation are designed to handle long distances and high volumes, connecting offshore production sites with onshore processing facilities.

- Chemical Injection/Flow Assurance: Pipelines used for chemical injection prevent hydrate formation and paraffin buildup, essential for maintaining smooth flow in extreme underwater conditions.

- Subsea Processing: Pipelines transport processed fluids within subsea production systems, particularly in regions with complex production layouts.

- Others: Including water injection and CO₂ transport, these applications support enhanced oil recovery and carbon capture initiatives.

Regional Analysis

- North America: North America, led by the United States and Canada, is a key market due to offshore developments in the Gulf of Mexico and the need for pipeline infrastructure to support extensive oil and gas operations.

- Middle East & Africa: This region is driven by large offshore reserves and substantial investment in offshore oil and gas infrastructure, particularly in the Persian Gulf.

- Asia-Pacific: Countries such as China, India, and Australia are increasing offshore exploration efforts, with substantial investments in offshore pipelines to support regional energy needs.

- Europe: Europe’s North Sea operations continue to rely on offshore pipelines, especially as the region emphasizes energy security and diversifies energy sources.

- Latin America: Brazil’s offshore activities and growing investments in pre-salt formations are expected to drive the demand for offshore pipeline solutions in this region.

Current Market Trends

- Focus on Pipeline Security and Monitoring: With offshore projects subject to environmental scrutiny, there is an increasing focus on pipeline security and leak detection. Advanced technologies, including remote monitoring and AI-driven analytics, are being adopted to mitigate risks.

- Adoption of Corrosion-Resistant Materials: Innovations in materials such as corrosion-resistant alloys (CRAs) and composite materials are increasing the lifespan of offshore pipelines, particularly in corrosive subsea environments.

- Digitalization and Automation in Operations: The use of digital tools for remote monitoring, predictive maintenance, and automated inspection is growing, helping operators manage pipeline performance more effectively.

- Environmental and Safety Regulations: As environmental concerns heighten, stringent regulations around pipeline installation and maintenance are increasing. This regulatory focus drives investment in eco-friendly materials and practices.

- Expansion in LNG Transport: With the rise in LNG demand, offshore pipelines are increasingly designed to transport natural gas, with a growing need for infrastructure to support LNG production and distribution.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand — Head of Business Development & Strategy

info@snsinsider.com

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)