In today's fast-paced world, managing your finances efficiently is a vital skill. Whether you're saving for a big purchase, paying off debts, or simply trying to make ends meet, having a well-organized system for tracking and managing your bills is crucial. One tool that can greatly simplify this process is a bill planner spreadsheet.

The Importance of Bill Planning

Before we dive into the world of bill planner spreadsheets, let's understand why it's so important to have a structured approach to managing your bills. Bills, which encompass utilities, rent or mortgage, credit card payments, insurance, and more, often come with various due dates and payment amounts. Without a clear plan, it's easy to forget or mix up these essential financial responsibilities.

Late payments can result in fees, interest charges, and a negative impact on your credit score. By contrast, effective bill planning not only ensures timely payments but also helps you gain control over your finances, reduce stress, and work towards your financial goals.

What is a Bill Planner Spreadsheet?

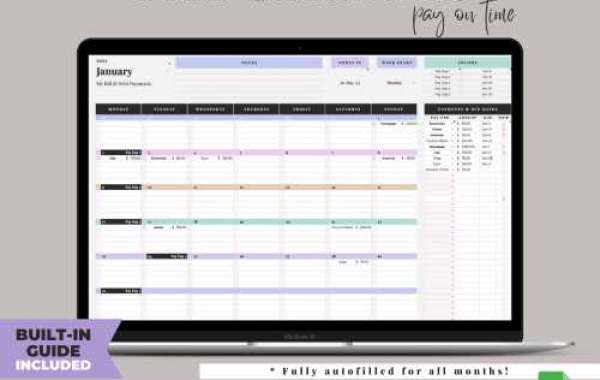

A bill planner spreadsheet is a customizable, digital document that allows you to input and organize all your bills, due dates, payment amounts, and payment methods in one place. This simple yet powerful tool can make a significant difference in your financial life. Here's why:

Organization: With a bill planner spreadsheet, you can see all your bills at a glance. No more sifting through envelopes, emails, or paper statements. Everything is neatly organized in one file.

Budgeting: The spreadsheet allows you to budget effectively by showing you how your bills fit into your income and overall financial plan. You can also track expenses and identify areas where you can cut costs.

Automation: Many bill planner spreadsheets can be set up to send you reminders or even automate payments, ensuring you never miss a due date.

Financial Goals: By keeping track of your bills and payments, you can see the bigger picture and work towards financial goals, whether that's saving for a vacation, paying off debt, or building an emergency fund.

Financial History: Over time, your bill planner spreadsheet becomes a historical record of your financial activities, which can be valuable for tax purposes or for analyzing your spending habits.

Creating Your Bill Planner Spreadsheet

To create your own bill planner spreadsheet, you can use software like Microsoft Excel, Google Sheets, or specialized budgeting tools. Here are the essential steps to get you started:

List Your Bills: Begin by listing all your recurring bills, including due dates, payment amounts, and payment methods.

Categorize Your Bills: Group your bills into categories such as utilities, rent/mortgage, insurance, and subscriptions. This will help you see where your money is going.

Set Up a Monthly Calendar: Create a calendar view where you can input your bills' due dates. You can use conditional formatting to highlight approaching due dates.

Calculate Your Total Monthly Expenses: Sum up all your bills for each month to get your total monthly expenses. Compare this with your monthly income to ensure you're not overspending.

Track Payments: As you pay your bills, mark them as paid in your spreadsheet to keep a record of your payments.

Automate Reminders: If possible, set up reminders or automated payments to ensure you never miss a due date.

Conclusion

A bill planner

spreadsheet is a valuable tool that can help you take control of your financial life, reduce stress, and work towards your financial goals. By creating and maintaining an organized system for managing your bills, you'll be well on your way to achieving financial success. So why wait? Start creating your own bill planner spreadsheet today and take the first step towards mastering your finances.

For more info :-

Source Url ;- https://sites.google.com/view/thrivingkoalav/home